Accountants create budgets by aggregating multiple assumptions over levels of activity, headcount, costs, growth rates and similar factors.

Accountants create budgets by aggregating multiple assumptions over levels of activity, headcount, costs, growth rates and similar factors.

Any budget review should initially focus on the underlying assumptions and policies before considering the numbers.

Given high levels of uncertainty over future demand, revenue forecasts are seldom more than inspired guesses by client-facing teams that are almost certainly wrong.

The challenge is to arrive at sensible assumptions over the headcount, productivity, salary and space requirements needed to support different levels of predicted demand.

In addition, given the usual inter-dependencies, it’s important to explore the people consequences of alternative ways of meeting demand.

For example, setting salaries materially below market or cutting back on training may save money in the short-term but tends to result in higher levels of employee dissatisfaction and turnover.

This irritates clients, increases stress and reduces productivity for those having to deliver client services whilst hiring/training new people.

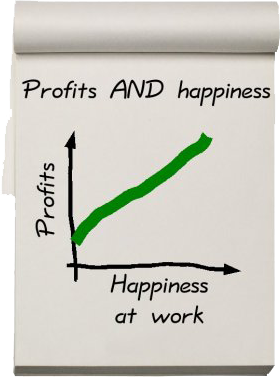

So here’s the new bottom line:

- Salaries and related costs are one of the few items that can be easily varied in an income statement;

- HR experts have a better understanding of people issues than accountants;

- HR experts should have more involvement in formulating the assumptions underlying budgeted remuneration and people-based expenditure as they mainly have to deal with the consequences.

Richard Chaplin runs the Managing Partners’ Forum. For more information, check out www.mpfglobal.com

Recent Comments