New global research that I recently carried out on behalf of the British Government identified GBP 5.9bn in incremental new business opportunities for UK sports marketing and consultancy services sector across 55 one-off single global sports and entertainment events over the next decade.

New global research that I recently carried out on behalf of the British Government identified GBP 5.9bn in incremental new business opportunities for UK sports marketing and consultancy services sector across 55 one-off single global sports and entertainment events over the next decade.

These findings are being used by the British Government to inform its strategy for the future development of the UK’s professional and business services sector, published Thursday 11 July 2013.

The UK’s professional and business services (PBS) sector is a global success story and the growing UK sports marketing and consultancy services segment is set to be worth of GBP 1bn over the next decade in the wake of the phenomenal success of London 2012.

My independent report – ‘Global opportunities for sports marketing, infrastructure and consultancy services to 2022′ (July 2013) has been referenced by the British Government and has influenced the Department for Business Innovation and Skills (BIS) strategy for supporting PBS sector in the UK.

Overview of the Report

- Sports marketing and consultancy services are an important and fast growing part of the UK’s professional and business services sector.

- UK sports marketing and consultancy services are forecast to be on course to surpass GBP 1 billion in revenues by 2022

- There is large scale and growing global market opportunities and the research identified and evaluated 55 non-recurring major global sports events scheduled to 2022. These offer the prospect of an estimated GBP 5.9 billion worth of expenditure opening new business opportunities.

- The UK sector is well placed to compete for these opportunities. The phenomenal success of London 2012 provides an unrivalled “shop window” for our excellence in sports and event-related services.

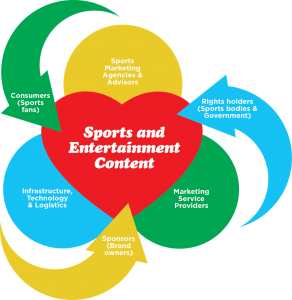

Dynamics of the UK sports marketing and consultancy sector

The UK sector forms an eco-system of business services with sports and entertainment content at its heart. It’s highly fragmented and mainly comprises small and medium-sized businesses in three broad areas: sports marketing agencies and advisors, marketing services providers, and infrastructure, technology/media and logistics providers.

It’s highly fragmented and mainly comprises small and medium-sized businesses in three broad areas: sports marketing agencies and advisors, marketing services providers, and infrastructure, technology/media and logistics providers.

The UK sector is growing strongly: currently valued at an estimated GBP 500-750m, its forecast to surpass GBP 1bn in revenue by 2022 and is looking increasingly beyond mature European markets to opportunities in fast growing economies in Asia and the Middle East.

Business interviewees for this research were uniformly positive about future growth prospects for the UK industry to 2022.

Main growth drivers for the UK sector

- The large scale operational and infrastructure budgets associated with forthcoming major global sports events are expected to open incremental business opportunities for the UK sector.

- Growing economies are using sport as a catalyst to significant inward investment and tourism, e.g. FIFA World Cup Qatar 2022.

- Sports sponsorship is seen as a powerful vehicle for global brands to advertise and connect with consumers – especially in growing economies like China, India, Russia and Qatar.

- The success of London 2012 – the best showcase for the UK sector in a generation.

- The impact of new technologies – opportunities and challenges in the “entertainment economy”, e.g. engagement of users via mobile devices and “second screen” viewing opportunities.

- There is increasing recognition of the contribution of women consumers in sports marketing

Global sports marketing and entertainment opportunities

There are 55 non-recurring major global sports events to 2022 offering an estimated GBP 5.9 billion worth of expenditure in incremental business opportunities. One third of these events will be hosted in Western and Northern Europe.

The top five national markets, ranked by the estimated values of events they will host, are:

- Qatar – GBP 1.7bn, e.g. FIFA World Cup 2022

- Russia – GBP 1.4bn, e.g. Winter Olympics & Paralympics 2014, FIFA World Cup 2018

- Brazil – GBP 1.3bn, e.g. FIFA World Cup 2014; Olympics & Paralympics 2016

- South Korea – GBP 0.5bn, e.g. Asian Games 2014, Winter Olympics & Paralympics 2018

- France – GBP 0.3bn, e.g. UEFA European Football Championship 2016.

Barriers to growth for the UK sector

Research contributors identified the following issues, which impact on the growth of UK sports marketing and consultancy businesses:

- The challenges of establishing local partnerships when targeting new overseas markets

- Getting to grips with unfamiliar legal frameworks in overseas markets, e.g. contract law, intellectual property.

- The challenge for smaller businesses to find the resources for exploratory visits to potential clients overseas.

- Growing international competition for the supply of services to major events, included some based on subsidy.

Strategies and recommendations

- The UK sector is encouraged to make the most of the “London 2012 effect” as a catalyst for securing new business overseas.

- It is important that the British Government ensures that the UK continues to host large sports events to showcase our experience and expertise to international markets.

- The UK sector must continue to build relationships with potential overseas clients to unlock new business at forthcoming global sports events.

- The UK sector must secure and sustain local partnerships in targeted overseas markets and deliver incremental services value by partnering with clients on their terms, e.g. to transfer knowledge/skills to them.

- The UK sector needs to achieve a stronger collective marketing approach in order to target new business in overseas markets.

- The UK sector needs to work alongside the Government that has a cohesive enabling/facilitation function that includes co-ordinating trade promotions, advice and mission activities.

- A new standard industry code (SIC) should be considered for the UK sports marketing and consultancy services sector given its importance to the PBS sector.

Reviews of the Report

“Packed with expert knowledge and insight, Ardi Kolah’s leading edge report delivers comprehensive analysis of incremental new business opportunities for sports marketing and consultancy services within the UK. Its robust and in-depth findings quantify the value of opportunities across major global events and make this report essential reading for all those in the sector actively seeking to accelerate their business development activities.” Frank Saez, MD, SMG Insight/YouGov

“This report is compelling and comprehensive. It lays out the enormous opportunity the UK has to make even more of a success of our sports marketing industry. As a country, there has never been a more important time to make the most of the world-leading industries we have –to grow our way back to confidence and prosperity. And as the Olympics showed, there has never been a better time either. We need to grasp this chance, rather than see it slip away from us. So decision-makers should study this report with rigour and speed, and resolve to make 2013 the year that the country gets 100% behind the sports marketing industry.” Francis Ingham MPRCA, Director General, Puplic Relations Consultants Association (PRCA), & Executive Director, International Communications Consultancy Organisation (ICCO)

“A valuable guide to the enormous business potential available to UK sponsorship and sport marketing companies on the global stage.” Karen Earl, Chairman, European Sponsorship Association (ESA)

Where to buy the Report

If you’re involved in sales and business development and would like to purchase the full 260 page report, click here.

Recent Comments