Retailers that simply try to appeal to shoppers during waking hours may be in for a shock, according to new research from the US by brand strategy consultants Vivaldi Partners Group.

Retailers that simply try to appeal to shoppers during waking hours may be in for a shock, according to new research from the US by brand strategy consultants Vivaldi Partners Group.

There’s a new breed of consumer that can’t actually be reached through traditional marketing channels and marketers need to have deployed strategies in order to reach this group who are active at any time of day.

And it’s not enough to break your customer base down into groups according to age and gender – marketers need to build up the fullest possible picture of each customer in order to target them with highly individualised messages.

The days of traditional bricks and mortar, 9am to 5pm shopping habits haven’t completely disappeared but increasingly consumers are now comfortable shopping in the twilight hours whether through mobile, offline advertising, or TV channels.

Today’s consumers are constantly connected and as a result they are in a state of continuous partial attention. The challenge for brand owners is that they begin to lose the power of engagement over one long consistent message.

Instead brand owners need to break the message into bite size pieces and communicate with their audiences on a more frequent basis at a time that suits them.

A good example of this change in sales and marketing strategy is the youth fashion retailer Missguided. It offers free next day delivery for shoppers up until midnight, while sending out e-mails with offers throughout the night to ensure customers wake up to them the next day and operates around the clock in US, Australia, France and Europe.

A good example of this change in sales and marketing strategy is the youth fashion retailer Missguided. It offers free next day delivery for shoppers up until midnight, while sending out e-mails with offers throughout the night to ensure customers wake up to them the next day and operates around the clock in US, Australia, France and Europe.

These so-called ‘Always-On Consumers’ (AOC) now represent nearly half of the most valuable customer segments in the US.

This group can’t be segmented along neat demographic or socio-economic lines but instead exhibit five distinct behaviour types that once identified can provide marketers with clues as to why these consumers choose to connect with certain brands and not others.

“There are significant differences in how these consumers use or consume new technologies, why they use various new technologies, why they engage, how they connect with brands and how they shop.

“As a result, there are enormous implications for how to build brands with these consumers and how to connect with them in the future,” explains Dr Erich Joachimsthaler, CEO of Vivaldi Partners Group.

These patterns show how, where and when different consumers behave towards brands and businesses and how they use devices, social networks, and the internet and apps.

The US study surveyed 574 respondents (55% aged between 16-39 years old) by focussing on their consumption patterns and how they connected with brands and businesses as well as why they chose to do so.

In this way, the researchers felt they could more accurately understand the attitudes, values, beliefs, perceptions and behaviours of the different consumer groups that make up the AOC segment.

There are five distinct shoppers that fall into this description:

- “Mindful explorers” (27%)

- “Social bumblebees” (22%)

- “Ad blockers” (20%)

- “Focused problem solvers” (18%)

- “Deal hunters” (13%)

“Mindful Explorers”

Here, Mark is typical of this segment. He tends to keep a low profile and wants to protect his personal identity and data. He tends to be a news junkie and an avid gamer. In traditional marketing thinking he would be called an early adopter, so he’s likely to be one of the first to acquire Google glasses.

He’s a new product evangelist and will share his views widely. From a marketer’s perspective, this segment is very useful as it’s more likely than any other AOC to take a brand survey or join a brand’s online community because this will be seen as an opportunity to offer valuable feedback to brands that they care about.

He’s a new product evangelist and will share his views widely. From a marketer’s perspective, this segment is very useful as it’s more likely than any other AOC to take a brand survey or join a brand’s online community because this will be seen as an opportunity to offer valuable feedback to brands that they care about.

Social style

Compared with other segments within AOC, these consumers tend to spend less time on social networks and post less frequently. Although concerned about privacy and not wanting to be the centre of attention, these consumers have many online friends in the gaming community whom they’ve never met in person.

Shopping style

These consumers don’t spend spontaneously and only shop for items that they actually want to search for. Typically, a purchase decision is influenced by a number of information sources including recommendations from family and friends and online customer reviews.

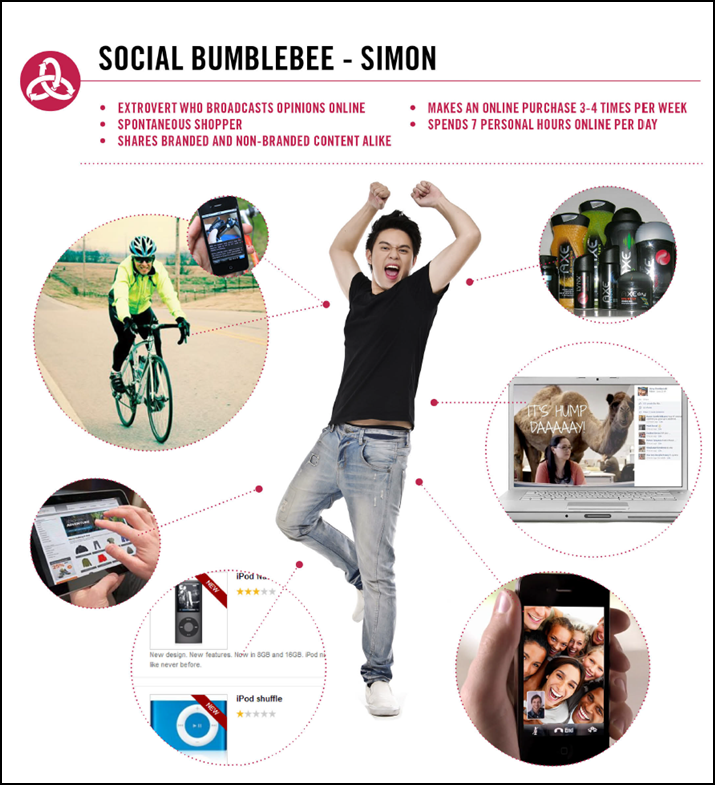

“Social Bumblebees”

Here, Simon is typical of this segment. He has a constant presence in the newsfeeds of 400+ Facebook friends and he usually posts 3-4 status updates a day, including links to his favourite songs and funny YouTube videos and brief, light-hearted posts about his daily activities.

These consumers are more extrovert than other AOC segments and aren’t afraid to broadcast their opinions.

These consumers are more extrovert than other AOC segments and aren’t afraid to broadcast their opinions.

As busy professionals they recognise that work colleagues can see their status updates and are more relaxed when it comes to privacy issues. They also tend to shop on the go via a tablet or iPad.

Social style

These consumers tend to use email mainly for work purposes and Facebook for keeping in touch with friends and family with daily, casual interactions. They are enjoying sharing content.

Shopping style

These consumers are much more impulsive and may even purchase goods that they may not have been searching for on the internet. Typically, when looking to buy a high ticket item, this group will Google the brand/product, read a handful of reviews and usually make a decision within a day or two.

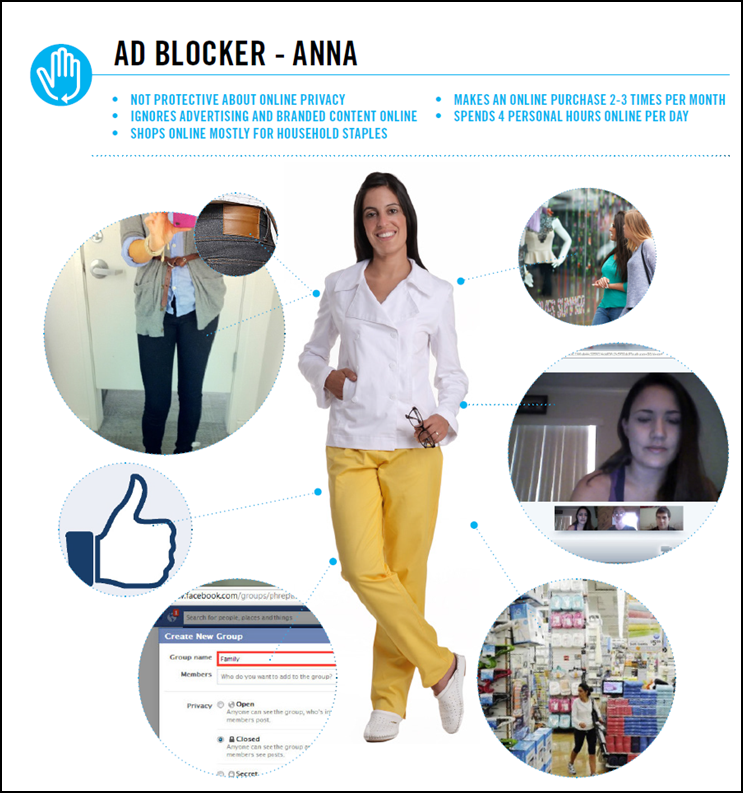

“Ad Blockers”

Here, Anna is typical of this segment and as the description infers, doesn’t like to be marketed to although she isn’t that protective about her online privacy. She tends to have less than 100 Facebook friends and tends to log in daily to chat and share updates with a relatively small but active circle of friends.

She doesn’t tend to pay too much notice to any online content unless it’s a message from someone she knows personally.

She doesn’t tend to pay too much notice to any online content unless it’s a message from someone she knows personally.

From a marketers’ perspective, using banner ads, branded content, news articles and blog posts aren’t likely to be that effective with this segment.

Social style

These consumers tend to have a tight-knit family and circle of friends. The typical type of social interaction is spent emailing this circle and browsing pictures on Facebook of these individuals where this personal connection exists. Although not extrovert by nature, these consumers don’t have a problem being the centre of attention once in a while.

Shopping style

This is perhaps the least active consumer group compared to other AOC segments as they tend to spend the smallest amount on shopping, both online and offline. Shopping online tends to be for cooking and cleaning supplies and other household items.

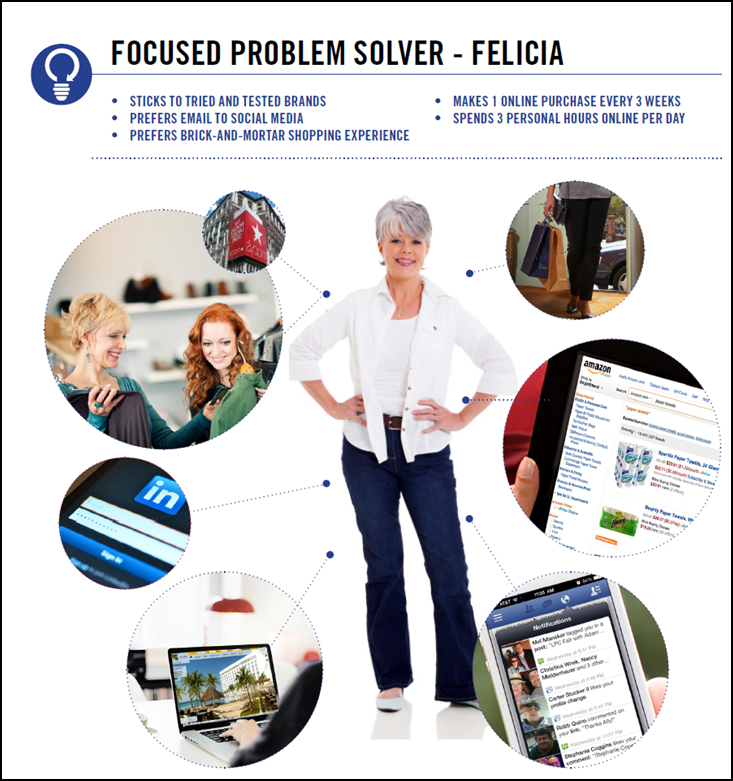

“Focused Problem Solvers”

Here, Felicia is typical of this consumer segment. They tend to have a higher age profile and are professionally qualified, often with a family. She is purposeful in her online activities and will not be fazed by managing her finances through online banking, making restaurant reservations, booking flights or holidays or other online transactions.

She tends to ignore the noise of social media and online advertising and sticks to tried and trusted brands and products. She will look at online reviews and recommendations and she is influenced by family and friends that will sometimes convince her to try something different.

She tends to ignore the noise of social media and online advertising and sticks to tried and trusted brands and products. She will look at online reviews and recommendations and she is influenced by family and friends that will sometimes convince her to try something different.

Social style

Typically, professional networks like LinkedIn are important to this segment and they tend to log in at least 2-3 times a week. They are also likely to log in to Facebook regularly to check photos and updates from family and friends. In terms of their own updates, they prefer using email rather than social media.

Shopping style

This segment tends to shop online for restocking staple household and personal care products. For bigger ticket items, these consumers prefer to bricks and mortar to online shopping so they can try out the product for themselves.

“Deal Hunters”

Here, Derek is typical of this customer segment and spends the most time online compared with the other AOC segments. His purchase behaviour is motivated by online discounts, editorial reviews, recommendations from trusted friends and family.

Although Derek is a loyal customer, he’s not given to writing reviews or becoming a vocal advocate of products that he may have purchased say on Amazon.

Although Derek is a loyal customer, he’s not given to writing reviews or becoming a vocal advocate of products that he may have purchased say on Amazon.

Social style

This consumer group are highly sociable and will have more than 500 Facebook friends but tend to be in ‘receive’ rather than ‘transmit’ mode and will infrequently post updates. They are also consumers that tend to spend a large proportion of their online time privately such as downloading music to their smartphones and exchanging emails with family and friends.

Shopping style

This consumer segment are always looking for a bargain and could be much more spontaneous when they come across a deal for a product that they might not have set out to purchase in the first instance.

They appreciate value for money. They also tend to spend a lot of time gathering information and comparing prices before making a purchase decision.

When it comes to making a decision, they will visit the company website to further research the product. Beyond that, they don’t tend to be over-engaged with brands and branded content.

Lessons to be learned by marketers

Although it may appear counter-intuitive, the research suggests that AOC that use mobile devices and hang out online are less likely to connect with brands and businesses as their interaction is driven by social rather than e-commerce.

In this permission-based economy, marketers need to earn the right to connect with AOC segments and as the research shows, many such segments differ greatly in terms of their willingness to interact with brands and they have different reasons for doing so.

“Consumers use multiple paths to purchase along the consumer journey. Traditional brand-building efforts such as integrated marketing communications efforts are unlikely to be effective,” warns Erich Joachimsthaler.

This new research is evidence that marketers need to stop being in what I call ‘transmit’ mode and switch to ‘receive’ mode, a point I make in my latest book, The Art of Influencing and Selling.

The traditional means of understanding consumers and their relationship to brands was to use quantitative research and focus groups. A popular qualitative method was to observe consumers in specific contexts through anthropological methods such as ethnography.

Today, many marketers now realise that surveys or focus groups are merely static snapshots of consumers’ attitudes, values, beliefs and perceptions. To some extent they tend to be backward-looking and as a result are quickly outdated. An ethnography provides rich and deep exploration, but a set of a dozen ethnographies isn’t data – it’s still just a collection of anecdotes.

Forward-looking marketers replace or supplement these ‘asking’ or ‘observing’ efforts with ‘listening’ efforts. By being in ‘receive’ mode, marketers can track signals as a by-product of how people use the internet and other real-time channels. They can track behaviour in the physical world through sensors and match social, mobile, browsing or location data sets.

In this way, marketers can have access to data in real-time and convert these inputs into insights and ultimately sales.

Recent Comments